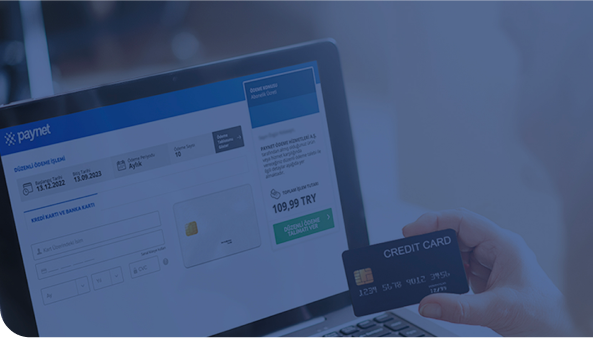

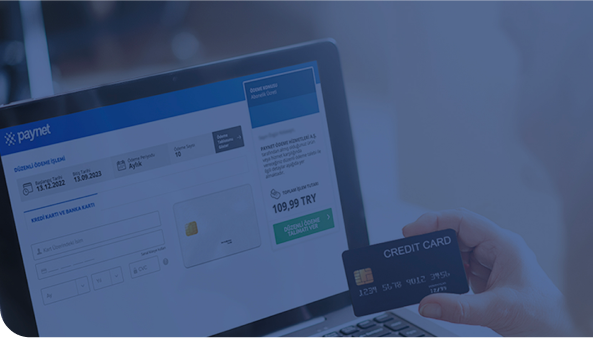

Dealer and Distributor Network Management

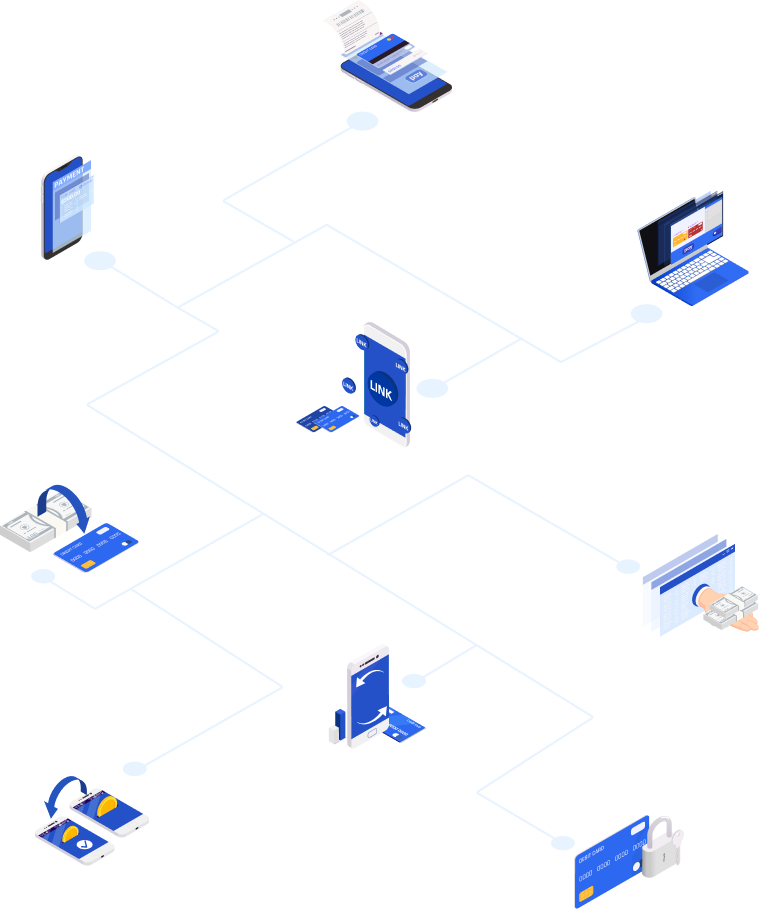

Easily manage your company's cash and collections flow across a network of dealers and distributors with Paynet's unique dealer network management solution.

Remove the barriers to your growth with the financial solutions we have developed as Türkiye's largest B2B2C payment institution!

Discover our innovative products, avoid lost sales and increase customer satisfaction!

Easily manage your company's cash and collections flow across a network of dealers and distributors with Paynet's unique dealer network management solution.

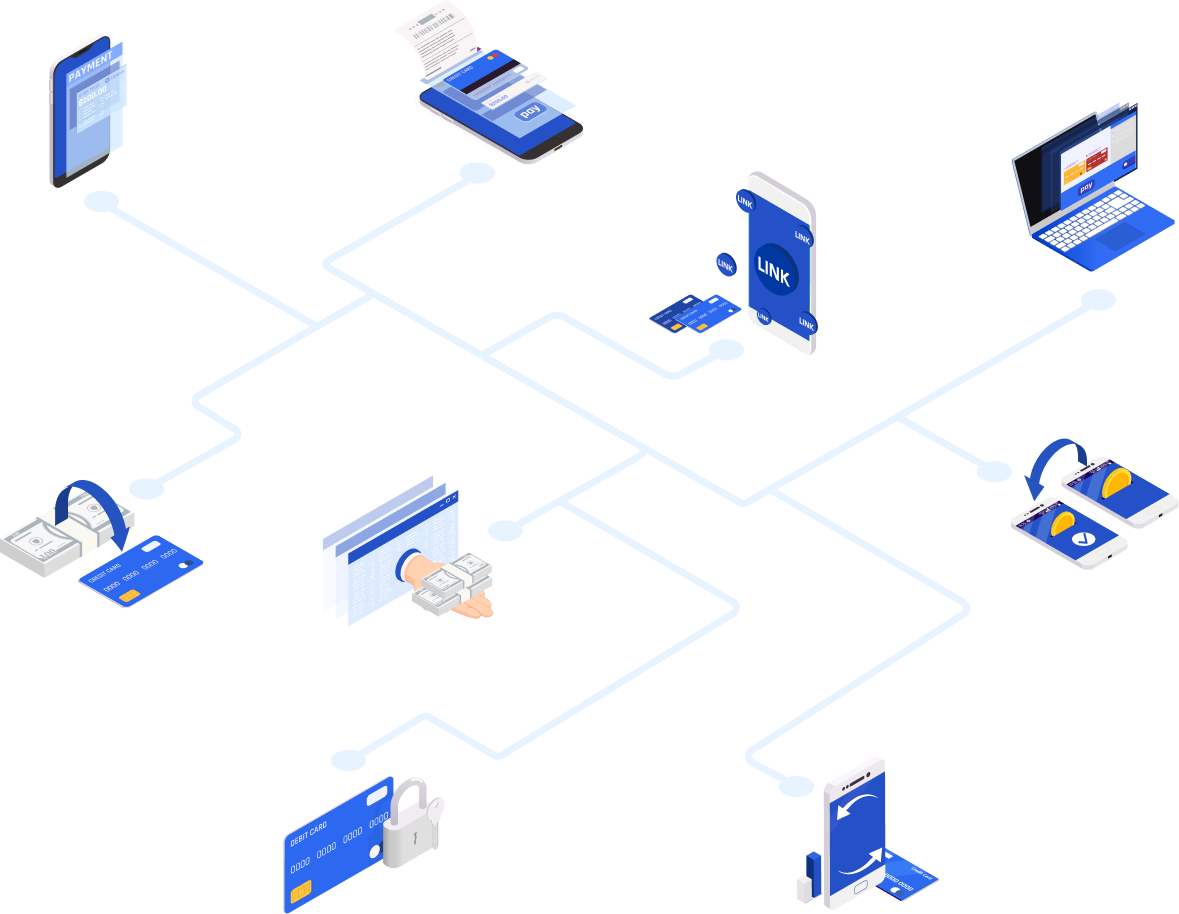

Eliminate the burden of signing up with each bank separately; receive payments in instalments from Türkiye's all card brands with a single contract

Simplify your business with Paynet's secure payment solutions

With Paynet, you can collect payments any time, anywhere and boost your company's sales performance.

Paynet ensured the successful completion of more than 2.5 million transactions in 2024

Get paid easily with our contracted card brands and increase your sales with the advantage of instalment payments!